Secure, personalized Bitcoin solutions: Book a call with the dedicated IT Team at The Bitcoin Way

TLDR:

Sending dollars over non-custodial Lightning is now possible.

FASB accounting rule changes aid Bitcoin adoption in corporate treasuries.

Analysts foresee up to $255BN flowing into Bitcoin in the next two decades.

12 megawatts of wasted gas get converted into BTC in Argentina.

Hey there, it's Bam and I’m super excited to bring you the seventh issue of Bitcoin News Weekly. If you haven't subscribed yet, click below to receive the latest breaking Bitcoin News delivered to your inbox weekly!

Let's explore this week's key points to understand why Bitcoiners worldwide are optimistic about its potential for positive change!

LATEST NEWS

🙌 Adoption:

River introduces “River Link”, a platform allowing easy Bitcoin transfers via text message to anyone, anywhere, regardless of their wallet or location.

With Get10101, users can now send dollars over Lightning using discrete log contracts (DLC) in a non-custodial manner.

Despite its CEO's criticism of Bitcoin, JP Morgan expands its internal crypto team threefold.

⚖️ Legal:

New FASB rules will measure Bitcoin at fair value, making it easier for corporations to adopt it as a treasury reserve asset.

Google revises its crypto ad policy, allowing crypto trust ads starting late January, aligning with the anticipated US approval of spot Bitcoin ETFs.

BlackRock, Fidelity, Grayscale, and other entities are maintaining ongoing discussions with the SEC to finalize the specifics of their spot Bitcoin ETF.

📈 Markets:

Galaxy Research's latest report forecasts net new inflows of $160-255 billion into Bitcoin and crypto over the next 20 years.

Saudi Aramco, the world's largest oil company, collaborates with Japanese finance giant SBI Holdings to investigate potential investments in digital assets.

Grayscale broadens its retail-focused advertising campaign for its spot Bitcoin ETF following a recent SEC filing.

⛏️ Mining:

Crusoe Energy is launching its second project in Argentina's Vaca Muerta oilfield, converting 2 million cubic feet of wasted gas daily to power 12MW worth of Bitcoin miners.

Marathon sets a new company record by mining 125.8 Bitcoin in a single day, valued at approximately $5.3 million.

Sabine Hossenfelder, a physicist and YouTuber boasting over 1 million subscribers, posts a video delving into how Bitcoin mining could potentially drive the advancement of renewable energy projects.

🗳️ Politics:

The JAN3 team engages Montenegro's Prime Minister to explore utilizing untapped hydroelectric potential for Bitcoin mining as well as developing a Bitcoin circular economy.

The Russian Finance Ministry proposes categorizing Bitcoin generated from mining operations as export goods, akin to gas export regulations.

“They are basically outlawing the technology by mandating a type of surveillance activity that makes no sense for the entities obligated to do it” – Coin Center’s Director of Research on Elizabeth Warren’s proposed anti-Bitcoin bill.

Looking for the simplest Bitcoin-only hardware wallet?

Bam’s 2 Sats: How to Avoid Fees (Pt. 2)

Let's pick up where we left off last week regarding the sovereign framework proposal. As previously mentioned, the aim is to lower costs as you increase your Bitcoin holdings through dollar-cost averaging, all while preparing for a period of high fees. If you missed the introduction, be sure to check it out.

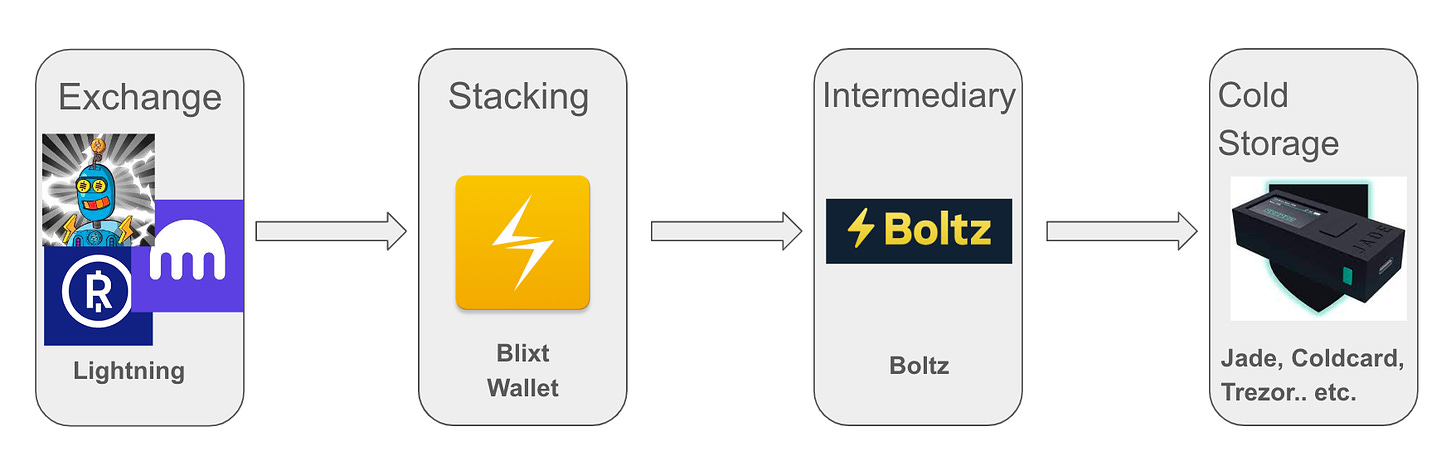

The idea is simple.

You stack sats via lightning into a self-custodial wallet.

Once enough funds are gathered, execute a submarine swap using Boltz to transfer funds to your cold storage.

Repeat.

I can recall when these terms seemed daunting. I'll do my best to explain them clearly here, but I can consider writing a more extensive tutorial later if you're interested 😉.

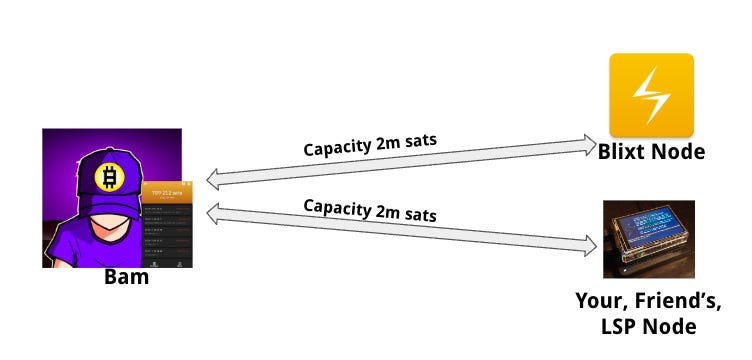

As many of us are aware, the Lightning network functions through channels. When using self-custodial wallets, it's crucial to consider both Outgoing and Incoming liquidity. Imagine opening a channel of 1 million satoshis to someone else; this action leaves us with 1 million in outgoing liquidity and 0 in incoming liquidity until we move some funds out of that channel. Keeping this in mind, I'm pleased to suggest the following setup, with Bam in the example using Blixt wallet.

The primary goal is to establish two or even three substantial channels directed toward highly connected nodes. We don't require more than that, and it's recommended to maintain no more than 5 or 6 channels, avoiding duplicating channels with the same peer.

To reach this point, our initial step involves receiving Bitcoin in our Blixt wallet, and the subsequent steps follow this strategy:

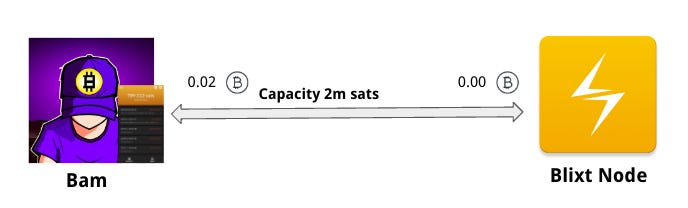

Receive slightly more than 2 million satoshis (around 2.2M) to accommodate the costs of opening channels and conducting swaps. Miner fees are currently high!

Your Blixt wallet will open an automatic channel toward their node.

Wait for the channel to be confirmed and active.

From Blixt, get an on-chain receiving address.

Visit boltz.exchange/swap, enter your Lightning amount and on-chain address, and then generate an invoice.

Pay the invoice with the Lightning funds in your Blixt wallet.

Wait to receive close to 2 million sats in your Blixt wallet.

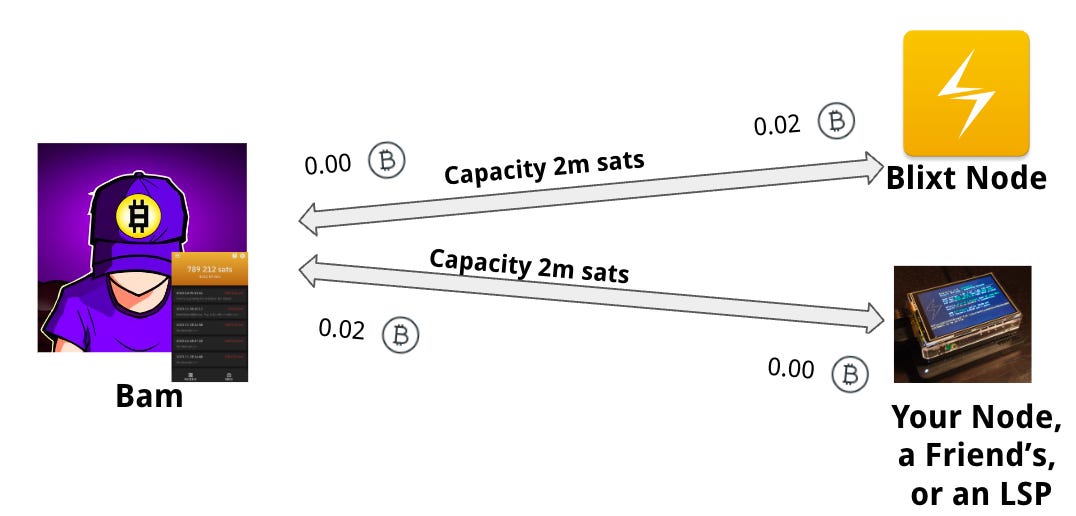

Next, seek out another reliable routing node to open your second channel. If you're unsure whom to use, I'd suggest considering NERV or UNITEDPLOW to open the second channel. (If you opt for the latter option, ensure your iPhone app doesn't go to sleep before the channel is active. This is a minor issue between lnd-cln, but it functions if the app remains active.)

Ultimately, your setup will resemble something like this:

This setup enables you to accumulate an additional 2 million sats (which will arrive from Blixt). Once you reach 4 million satoshis in your Blixt wallet, you can proceed to conduct another submarine swap, this time for close to 4 million, directed to your own node. With this process, you can transfer all liquidity to the other nodes' sides, obtaining 4 million incoming liquidity, enabling continuous stacking in a self-sovereign manner. This approach prepares you for a high-fee environment, which shall arise at some point in the future, even if Ordinals are to be filtered out.

Do you have any doubts concerning this method? If so, just write them down in the comments and let’s discuss!

Stay Humble & Stack Sats,

Bam

Are you a Bitcoiner or a Bitcoin company focused on promoting hyperbitcoinization? Reach out directly to rob@bitcoinnews.com to discuss how we could work together.

P.S. … We're all ears for your thoughts and suggestions on how to make this the ultimate Bitcoin resource in your inbox. Drop us a line by replying to this email and share what's on your mind. If you're digging our newsletter, why not spread the word and pass it along to a friend? 👇