Secure, personalized Bitcoin solutions: Book a call with the dedicated IT Team at The Bitcoin Way

TLDR:

Bloomberg reports that Bitcoin should be included in every portfolio.

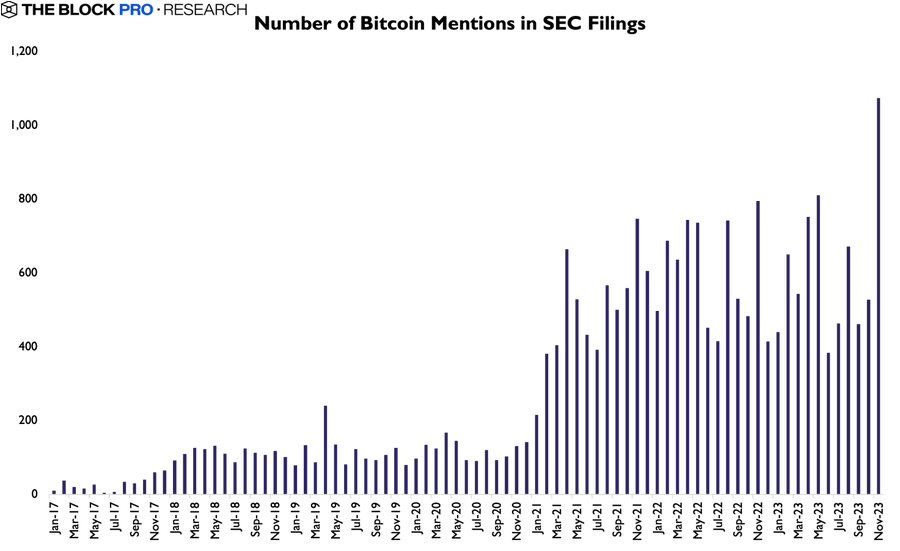

SEC filings mentioning 'Bitcoin' reach an all-time high.

Robinhood launches a Bitcoin trading app in the European Union.

Bitcoin miners in both US and UAE ink large equipment deals.

Hey there, it's Bam and I’m super excited to bring you the sixth issue of Bitcoin News Weekly. If you haven't subscribed yet, click below to stay informed with the latest breaking Bitcoin News delivered directly to your inbox every week!

In our previous publication, we detailed the surge to $42,000, followed by ongoing momentum to current levels of ~$44,000. The anticipation of multiple spot Bitcoin ETF approvals within the month appears to be fueling this excitement.

Let's explore this week's key points to better understand whether this is in fact the humble beginnings of the revered Bitcoin bull we’ve all been hotly anticipating.

LATEST NEWS

Adoption:

Bloomberg report acknowledges Bitcoin as a valuable addition to a balanced portfolio, signaling a significant shift in the narrative from years prior.

JAN3 launches its financial division that provides Over-the-Counter (OTC) Bitcoin services tailored for nation-states and HNWI’s.

IBM introduces a new Bitcoin cold storage solution named ‘IBM Hyper Protect Offline Signing Orchestrator’.

Legal:

The number of SEC filings mentioning Bitcoin hit an all-time high of 1,074 in November.

Swiss asset manager Pando files for a US spot Bitcoin ETF, marking the 13th entity to do so.

BlackRock releases another amendment to their spot Bitcoin ETF S-1 (prospectus), indicating active efforts by both the SEC and issuers to resolve underlying details behind the scenes.

Markets:

Robinhood launches a Bitcoin and cryptocurrency trading app in the European Union.

Swan Bitcoin inaugurates an Institutional Division, raising and deploying $205 million across its equity, credit, and hedge funds in 2023.

Itau Unibanco, Brazil's largest private bank, set to launch a Bitcoin and cryptocurrency trading service.

Mining:

Riot Blockchain purchases 66,560 ASICs from MicroBT for $290.5 million, averaging approximately $4,360 per machine.

There are currently 14 companies engaging in greenhouse gas-negative Bitcoin mining - effectively reducing emissions by utilizing flare gas as a power source.

UAE-based Bitcoin mining company, Phoenix Group PLC, places an order for mining equipment valued at $136 million from Whatsminer ASICs maker Microbt, with an option for an additional purchase worth $246 million.

Politics:

El Salvador, in collaboration with Tether, introduces the 'Freedom Visa' program, granting residency and a route to citizenship for investors who invest $1 million in Bitcoin or USDT.

Lugano, Switzerland, adopts Bitcoin as a means of payment for taxes and fees through the Swiss financial services provider Bitcoin Suisse.

Rumors are circulating about a LATAM presidential candidate utilizing Blink Wallet, a custodial Lightning wallet.

This newsletter got you so bullish you want to smash buy?

Bam’s take:

This week, I have something special to share. I've created a framework to attain sovereignty, even amidst a high-fee environment in the world of Bitcoin. It might take a bit more time to explain, but stay with me because it could significantly impact your ability to stack more sats in the future.

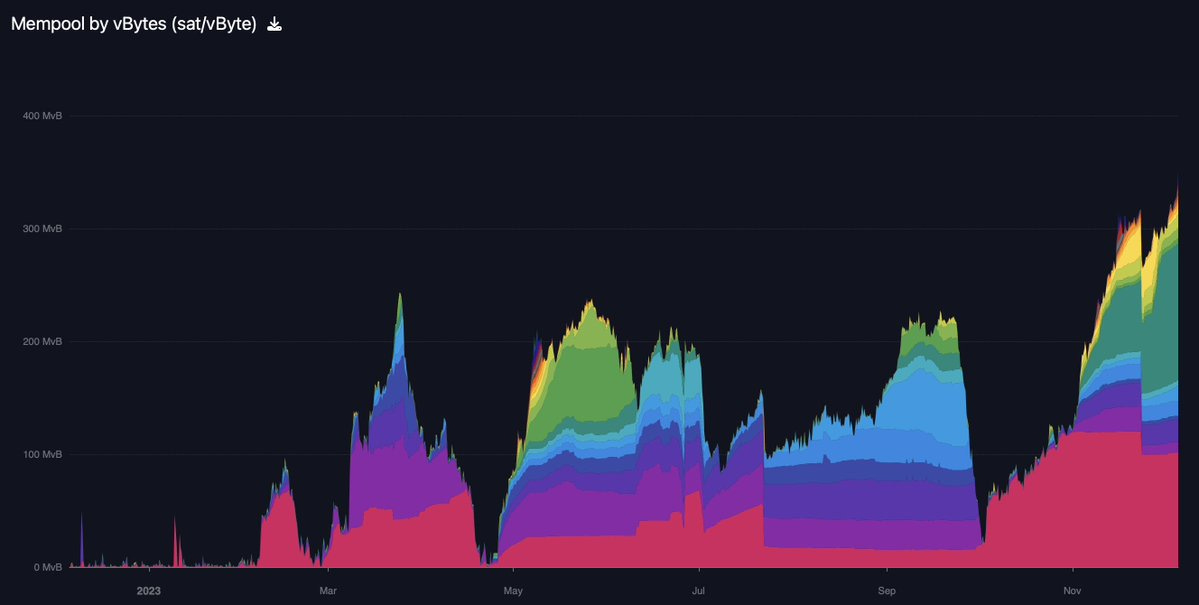

The continuation of high fees linked to Ordinals, ETF front-running, and Bitcoin's rising recognition as the most reliable form of money sends a clear message: a long-term high-fee environment appears almost inevitable.

Here's the main issue: While stacking, we aim to minimize fees and retain control of as much of our funds as possible. However, frequently accumulating and sending UTXOs under 1 million sats (~$440) can lead to higher fees when these funds are moved later on:

At 50 sats/vbyte, fees on moving 1M sats are ~12,500 sats (1.25%)

At 100 sats/vbyte, fees on moving 1M sats are ~25,000 sats (2.5%)

Consider the implications when accumulating sats in batches between $100-$200 or smaller — the fees could account for a significant portion of the intended transaction value.

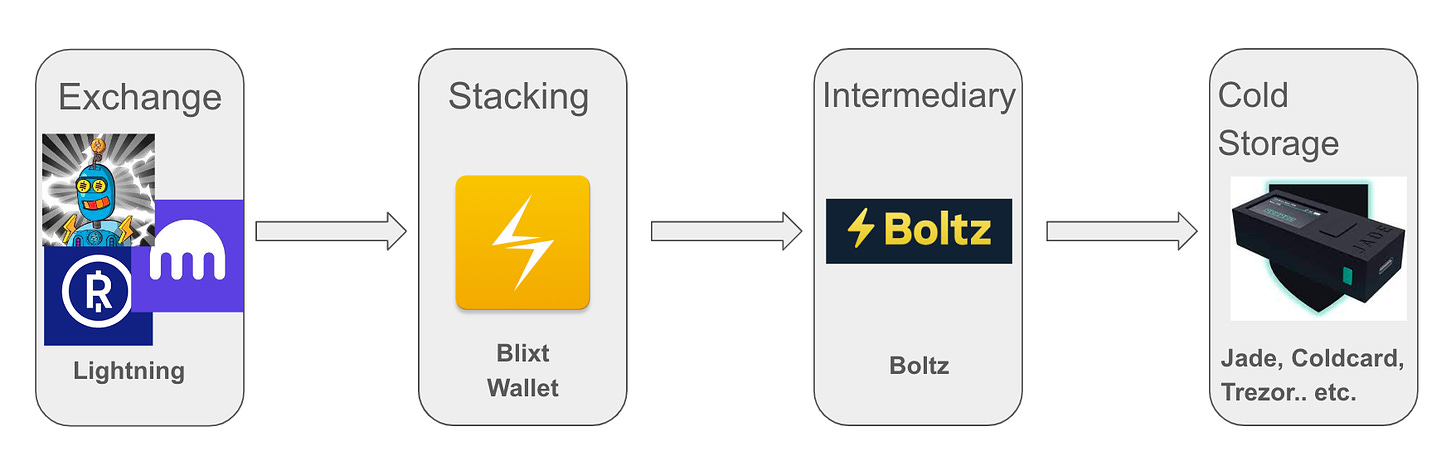

A frequently used solution involves accumulating on exchanges or custodial lightning wallets until reaching a sufficiently large UTXO size. However, this comes with the tradeoff of potential custodial and regulatory risks.

Let me introduce to you a potential solution.

The concept is to employ Blixt, a non-custodial lightning wallet, and configure it with larger channels (2-3 million sats) for accumulating sats independently. Later, utilize an intermediary to transfer these funds to cold storage via Boltz submarine swaps. This method reduces stacking fees, enabling consolidation into your hardware wallet with a single miner fee at a later stage.

Interested in learning how to execute this strategy yourself? We'll delve deeper into the implementation details in next week's issue!

Stay Humble & Stack Sats,

Bam

Are you a Bitcoiner or a Bitcoin company focused on promoting hyperbitcoinization? Reach out directly to rob@bitcoinnews.com to discuss how we could work together.

P.S. … We're thrilled to be a part of your weekly routine, and we'd love to hear your thoughts and suggestions! Reply to this email and let us know what's on your mind. If you're enjoying our newsletter, why not share the love and send it to a friend?👇

Great, thanks! I'm wondering if it would be worthy - in the post when you'll discuss "how to execute this strategy yourself" - to briefly explain also the prons/cons of using Blixt instead of some other not custiodal LN wallet (e.g. Phoenix). Thanks again!