TLDR:

Bitcoin's price soars to $37,000, the highest in 18 months.

Merchant adoption of Bitcoin in El Salvador gains momentum.

BlackRock anticipates imminent Bitcoin ETF approval.

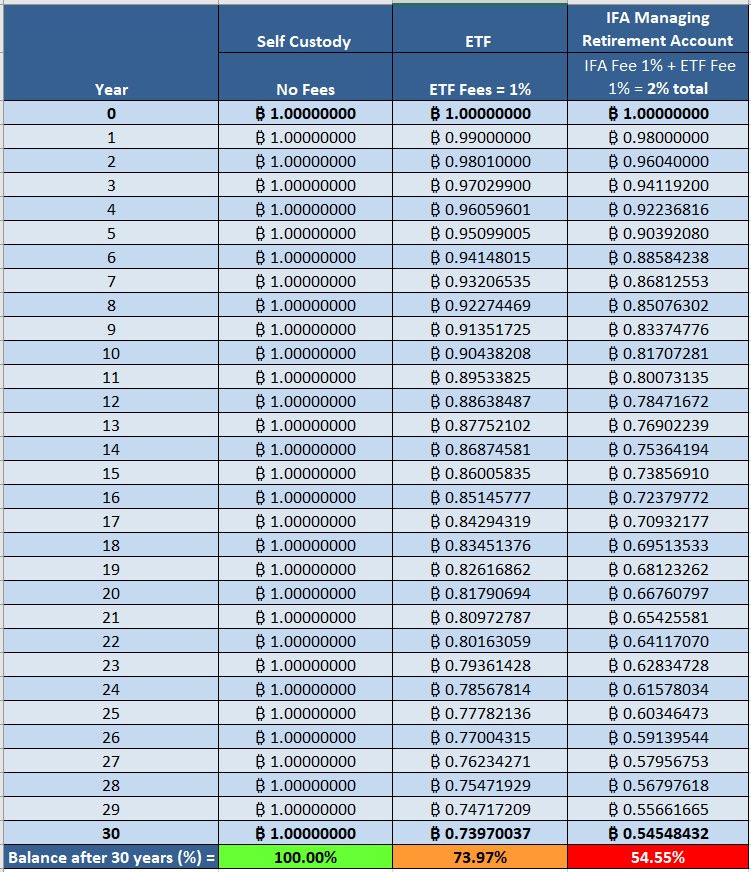

Over 30 years, ETF fees reduce BTC holdings by 46%.

Hey there, it's Bam! Very excited to bring you all the second issue of Bitcoin News Weekly. As we all might have seen, felt and experienced this past week, Bitcoin’s price has shown strong signals, reaching and hovering around $37,000 for the first time in roughly 18 months.

And while the price backs up our conviction, development continues at a steady or even accelerated pace. So let me help you stay up to date on all new developments going on this past week. Let's dive right in!

LATEST NEWS

Adoption:

Adopting Bitcoin, the Salvadoran conference, had more than 1,100 attendees, with more than 30% representing El Salvador natives, up from ~0% last year. Attendees were even paying their hotel bills with Bitcoin over the Lightning Network.

Blink Wallet announces a partnership with Distribuidora Morazán, a supplier of 40,000 merchants in El Salvador, who now can pay their bills in bitcoin with a 5% discount.

BitVM creator Robin Linus introduces BitStream, a Decentralized File Hosting Incentiviced via Bitcoin Payments, an open market for content hosting, enabling individuals to monetize excess bandwidth and storage via Lightning.

Legal:

Fox Business reported that Blackrock is growing increasingly confident that the SEC will approve its Bitcoin ETF by January.

U.S. lawmakers introduce the Creating Legal Accountability for Rogue Innovators and Technology (CLARITY) Act, which blocks government officials from transacting with iFinex, the Chinese parent company of Tether.

Gemini implements “The Travel Rule” for UK customers, aiming to thwart the use of cryptocurrencies for illicit purposes.

Markets:

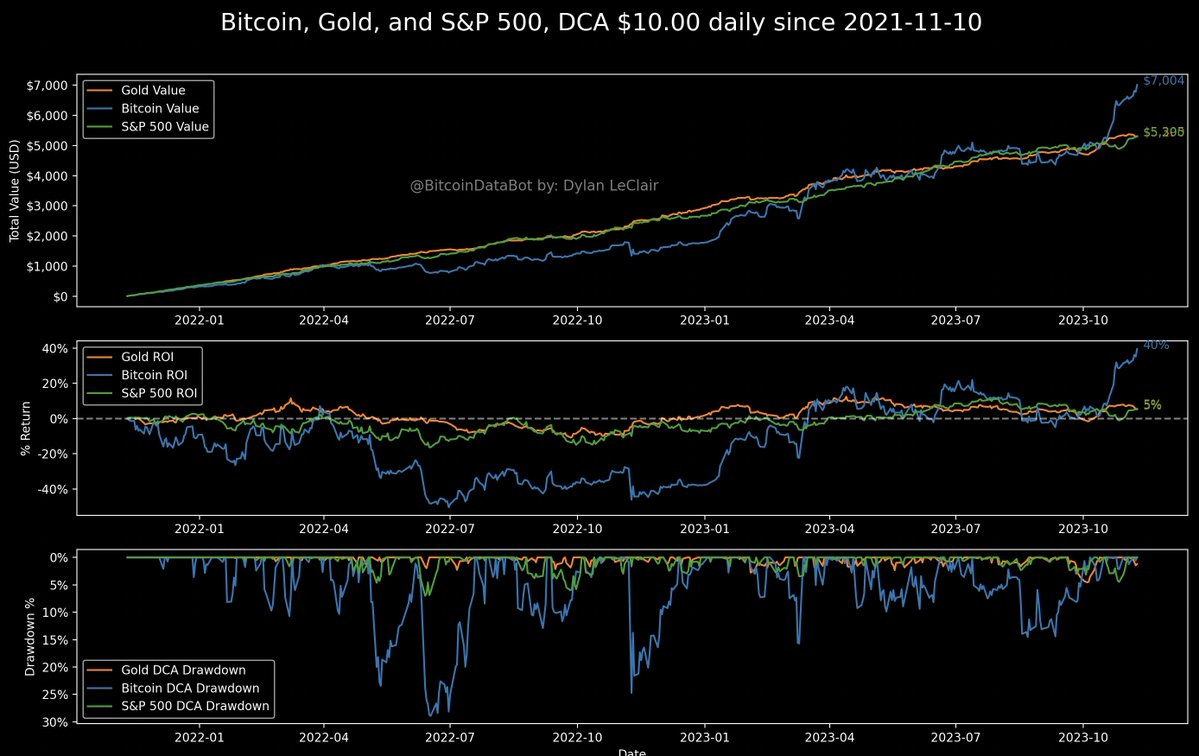

Dollar-cost averaging bitcoin, stocks, and gold, starting from 11/10/21, the day of the $69,000 bitcoin all-time high until today, showcases and puts bitcoin as the fastest horse: Bitcoin +40%, Gold +5%, S&P +5%

Fidelity, $4.5 trillion asset manager, releases the report “Revisiting Persistent Bitcoin Criticisms”, dispelling common bitcoin FUD.

WisdomTree Enhanced Commodity Strategy Fund to invest up to 5% of its net assets in Bitcoin future contracts.

Mining:

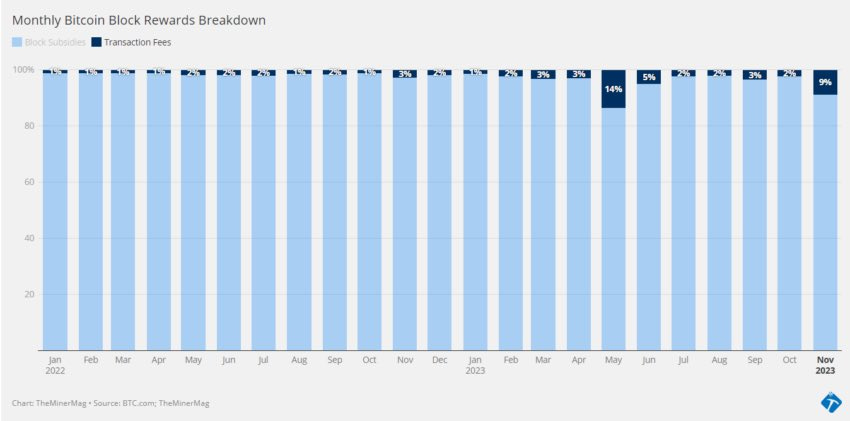

Bitcoin miners have collected approximately 830 BTC in transaction fees this month, totaling $30.7 million, comprising 9% of their monthly rewards—the highest percentage since May.

Integrating an S9 Bitcoin miner into your home can offset heating costs while making you the hardest money on Earth.

“Bitcoin mining heavyweights Marathon Digital and Riot Platforms are among the most overvalued crypto mining companies relative to their competitors” – MinerMetrics founder Jaran Mellerud.

Politics:

Moody’s cuts the outlook on the US credit rating from stable to negative, citing risks to the nation’s fiscal strength.

French investment bankers receive an email from BlackRock promoting a webinar for their iShares Swap ETF products on Nov. 15th (within the 8-day spot Bitcoin ETF approval window).

The US branch of Industrial and Commercial Bank of China Financial Services, the world's largest bank by total assets, suffered a ransomware attack that disrupted US Treasury auction activities.

BAM’S TAKE

The anticipation for the approval of a Bitcoin ETF is growing, with Bloomberg analysts suggesting an 8-day window starting on November 9th during which the SEC could potentially approve all 12 spot ETFs simultaneously. The market is already responding to this possibility, as approval is believed to trigger substantial inflows, potentially adding billions to Bitcoin's market capitalization.

But why is the approval of an ETF viewed as so crucial for Bitcoins success?

For those with a history in Bitcoin, the initial experience of taking control of personal keys can be daunting. On the regulatory front, some institutions desire exposure to this asset class but are hindered either by restrictions or a lack of expertise, fearing a high risk of loss.

An ETF, in essence, elevates Bitcoin's status as a credible investment class in the public eye. Given the prevailing high inflation and negative yields on US Treasuries—traditionally deemed the world's safest asset—investors may increasingly explore alternatives like digital assets, valued for their scarcity and resistance to manipulation.

The pivotal question is whether investing in a Bitcoin ETF is a worthwhile endeavor. It's crucial to acknowledge that even seemingly low ETF fees can accumulate significantly over time. For instance, a 1% fee over a 30-year period could diminish your initial holdings to just 54%. Despite this, in the face of substantial appreciation, it may still outperform fiat. While self-custody remains the optimal choice for maintaining complete ownership, a spot ETF offers undeniable advantages. It opens avenues for Bitcoin exposure through pension accounts, presenting benefits that might outweigh the slight loss of value due to fees.

Stay Humble & Stack Sats,

Bam

P.S. Let us know how you think we did 👇