TLDR:

The number of Bitcoin addresses surpasses 50 million.

ARK sells $130 million of GBTC to finance their own Bitcoin ETF.

MicroStrategy acquires additional bitcoin, totaling ~175,000 BTC.

Jan3 executive team meets with the Presidents of Suriname and Colombia.

Hey there, it's Bam! I'm thrilled to present the fifth issue of the Bitcoin News Weekly newsletter. If you haven't subscribed yet, click the button below to join!

The recent price surge in Bitcoin has surprised many who still held a bearish sentiment. Despite anticipated corrections, Bitcoin has climbed past $42,000, a level not seen since April 2022. Amidst emerging FOMO and denial, the steadfast "DCA Army" continues accumulating sats, showcasing their unshakeable confidence in Bitcoin's growth. Let’s dive into this week’s highlights and check in on why everyone is so bullish!

LATEST NEWS

Adoption:

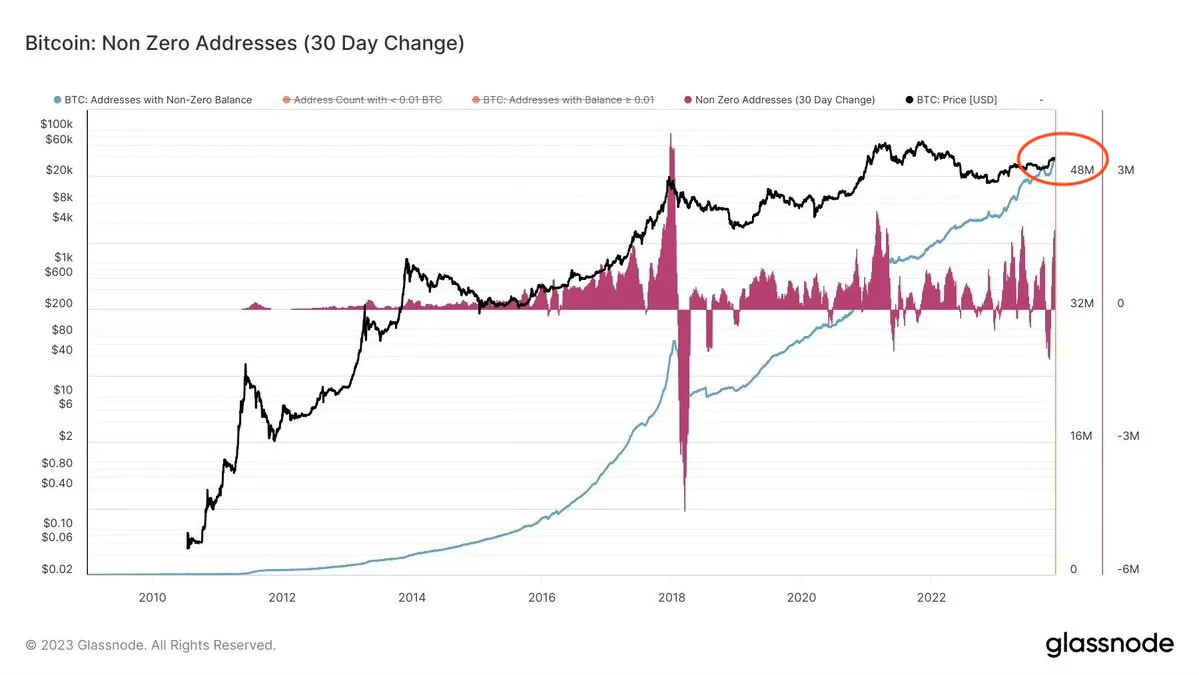

Bitcoin addresses with a non-zero balance surpasses 50 million.

The first Stable Channel broadcasts onto the Bitcoin mainnet over Lightning, equating shorts vs longs, providing a stable USD price for receivers, and bitcoin leverage for providers.

In Belgium, sixth-grade textbooks include education about Bitcoin for students.

Legal:

BlackRock is actively working with the SEC to secure approval for their spot Bitcoin ETF. January 10th marks the anticipated date for potential mass approval of all 12 applications.

Cathie Wood positions ARK to lead the initial stages of the spot Bitcoin ETF race by selling $130 million of GBTC to finance their own Bitcoin ETF.

Grayscale is proposing amendments to the Grayscale Bitcoin Trust agreement to align it with competitors. This shift involves transitioning from monthly to daily fee collection while retaining the existing 2% management fees.

Markets:

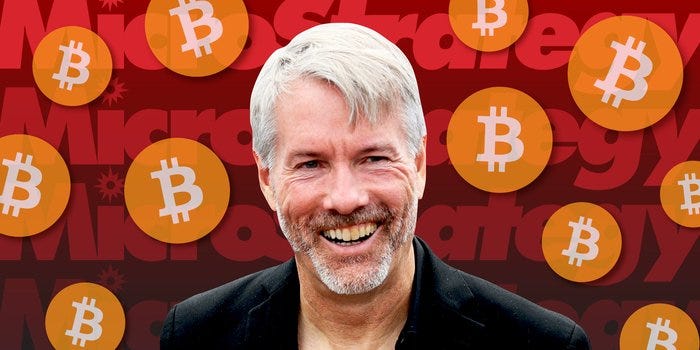

MicroStrategy adds 16,130 Bitcoin to their treasury. The company now hodls 174,530 Bitcoin acquired at an average price of $30,252 per coin.

Bitcoin surpasses $40,000 for the first time since April, 2022.

Standard Chartered forecasts Bitcoin reaching $50K in the next month, and $120K by the end of 2024.

Mining:

Jack Dorsey allocates $6.2 million to OCEAN, aimed at globally decentralizing Bitcoin mining through a transparent, non-custodial mining pool.

The Independent and other media outlets are changing their narrative, acknowledging bitcoin mining as a tool for the transition to renewable energy.

Bitcoin mining company DEMAND announces the world’s first StratumV2 mining pool, intending to enhance Bitcoin’s resistance to censorship.

Politics:

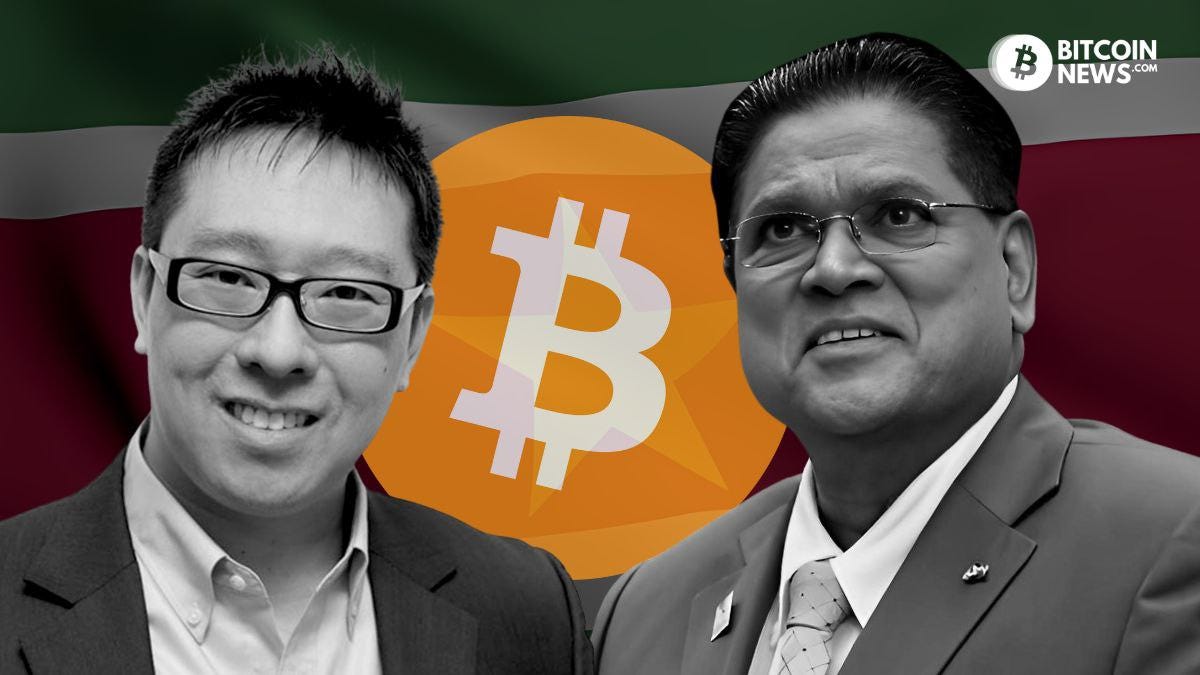

The Jan3 executive team holds discussions with Suriname’s President Chan Santokhi regarding Bitcoin adoption and its potential to expedite economic growth.

El Salvador generates a 31% profit from their bitcoin investment in just one year.

Jan3's CEO, Samson Mow, provides an exclusive video interview to Bitcoin News discussing his meetings with the Presidents of Colombia and Suriname, aimed at promoting Bitcoin adoption.

Enjoying what you're reading? Then we think you'd love the Bitcoin Breakdown newsletter. Check them out here!

Bam’s take:

Excitement seems to be seeping into the bitcoin ecosystem. Lately, I've noticed friends and family showing curiosity about Bitcoin. BlackRock's involvement has garnered increased media attention, prompting casual observers to contemplate exploring and learning more about it.

FOMO seems to be surfacing across all levels, whether institutional or among the so-called "plebs." Recent reports from CC15Capital highlight multiple whale addresses amassing significant Bitcoin holdings. MicroStrategy and another whale entity together withdrew over 26,000 Bitcoin from the market this week alone. To put it differently, their combined accumulation equals an entire month's issuance.

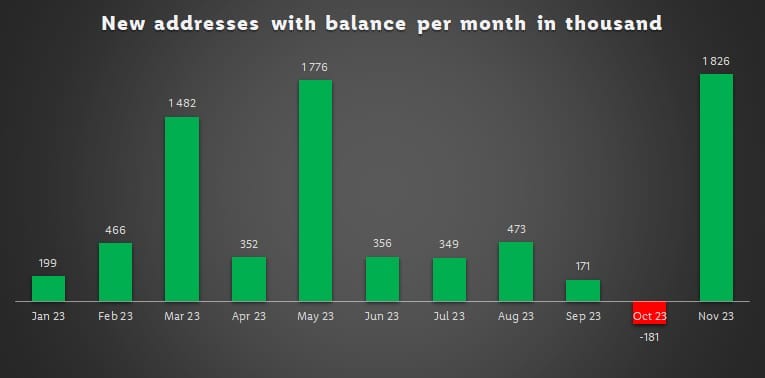

It's not just institutions rapidly accumulating the hardest asset on earth; the general public is also actively stacking. This month alone, nearly 2 million Bitcoin addresses were created and for the first time ever, over 50 million addresses hold a Bitcoin balance.

This time around, a vastly larger proportion of the population seems conscious of the Bitcoin halving and its influence on the price. Coincidentally, we're facing another potential supply shock: the Bitcoin ETF.

With the rising price, Bitcoin garners more interest from individuals, institutions, and even nation-states. With its limited supply, it's crucial not to let these opportunities slip away easily.

Stay Humble & Stack Sats,

Bam

This newsletter got you so bullish you want to smash buy?

P.S. … As we embark on this newsletter journey together, becoming a regular part of your weekly routine, your feedback means the world to us. Reply to this email and share your thoughts and suggestions. If you're finding value in what you're reading, consider sharing it with a friend to keep them informed as well.👇