TLDR:

Tether increases their holdings to 66,465 bitcoin.

Chainalysis reports a decline in bitcoin-related illicit activity.

Spot Bitcoin ETFs accumulate more than 80,000 bitcoin in a week.

Bitcoin Mining transforms rural Kenya.

Hey, it's Bam! I’m excited to bring you another edition of Bitcoin News Weekly! Haven't subscribed yet? Click below to get the latest breaking Bitcoin News delivered directly to your inbox every Monday!

The intrigue deepens as spot Bitcoin ETFs maintain record-breaking trading volumes on Wall Street! Despite one of the most hyped-up "bullish" events in Bitcoin history, community sentiment has noticeably turned for the worse. Let's explore the significant developments that unfolded this week in the world of Bitcoin and showcase why there's no need for pessimism.

LATEST NEWS

🙌 Adoption:

Tether boosts its holdings by 8,888 bitcoin, reaching a total of 66,465 bitcoin on their balance sheet valued at approximately $2.8 billion.

My First Bitcoin, the world's leading Bitcoin education program, secures a Discovery Grant from Block, empowering them to expand their language offerings.

Jose Simeon Cañas Central American University’s study reveals that 1 in 10 residents of El Salvador have utilized Bitcoin for payments.

⚖️ Legal:

Chainalysis' annual crypto crime report underscores a substantial decline in illicit activity, as the total received value plunges to $24.2 billion.

State Senator Azlan Salim of Virginia introduces a bill to safeguard citizens' fundamental rights related to Bitcoin.

The US Bankruptcy Court for the Southern District of Texas approves Bitcoin miner Core Scientific's Chapter 11 plan.

📈 Markets:

ARK Invest buys shares worth $15.9 million in its own spot Bitcoin ETF, ARK 21Shares Bitcoin ETF (ARKB).

Venture Smart Financial Holdings, a Hong Kong-based financial firm, plans to launch its spot Bitcoin ETF in Q1, targeting $500 million AUM by year's end.

Spot Bitcoin ETFs, excluding Grayscale, amass over 80,000 bitcoin in a mere 6 trading days.

⛏️ Mining:

A Bitcoin miner in Arkansas shuts down 4MW of mining power to relieve strain on the power grid during severe cold conditions in the region.

BitcoinShooter releases a documentary highlighting the pivotal role of Bitcoin mining in providing electricity to families in rural Kenya.

Bitcoin mining now utilizes 54.5% sustainable energy, marking the highest percentage among global industries.

🗳️ Politics:

Milei's speech at the World Economic Forum, advocating for freedom and the reduction of the state, becomes the most viewed talk of the conference.

Singapore Monetary Authority denies approval for spot Bitcoin ETFs.

FOX Business airs a segment explaining that the strength of Bitcoin is better assessed through hashrate rather than dollar price.

Looking for the simplest Bitcoin-only hardware wallet?

Bam’s 2 Sats:

After just over a week since the spot Bitcoin ETFs started trading, the fog is beginning to lift, providing clarity on the trends moving forward. I remember many of us wondering if BlackRock could amass as much bitcoin as MicroStrategy's stack of approximately 200,000 BTC. If so, how long would it take? And wouldn't it imply that the price would need to surge higher? I mean, who is selling out there?

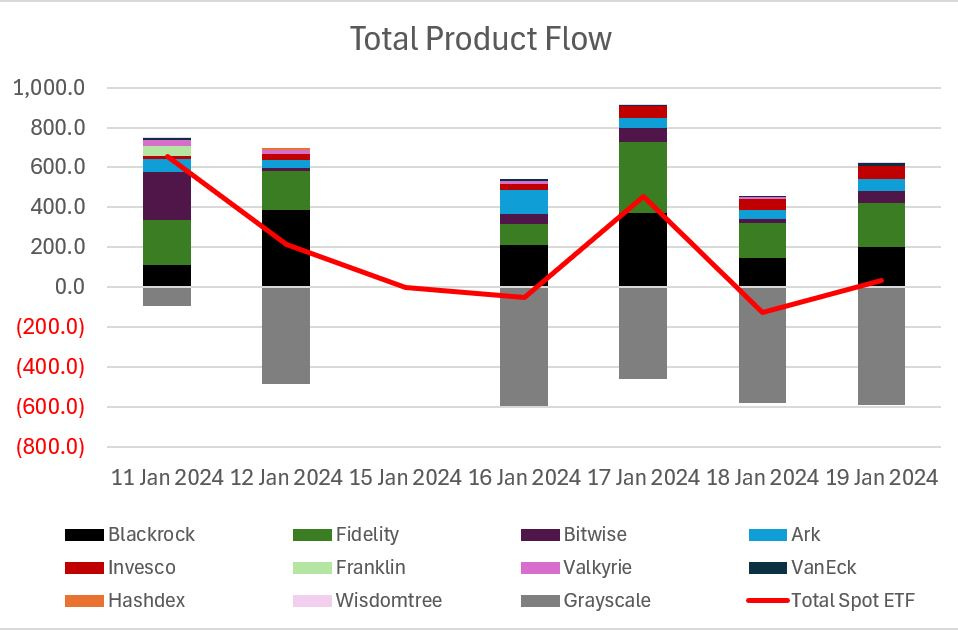

With six trading days in the books, it's evident that the net flows are positive, albeit marginally. Grayscale's significant outflows of over $2 billion, driven by investors seeking refuge from their hefty 1.5% fee (compared to Bitwise's 0.2%), play a crucial role. One could argue that the substantial outflows from Grayscale, combined with significant inflows to the other nine spot ETFs, resemble holding a beach ball underwater. This dynamic enables firms like BlackRock (33,706 bitcoin) and Fidelity (30,384 bitcoin) to accumulate substantial positions without triggering a significant price increase.

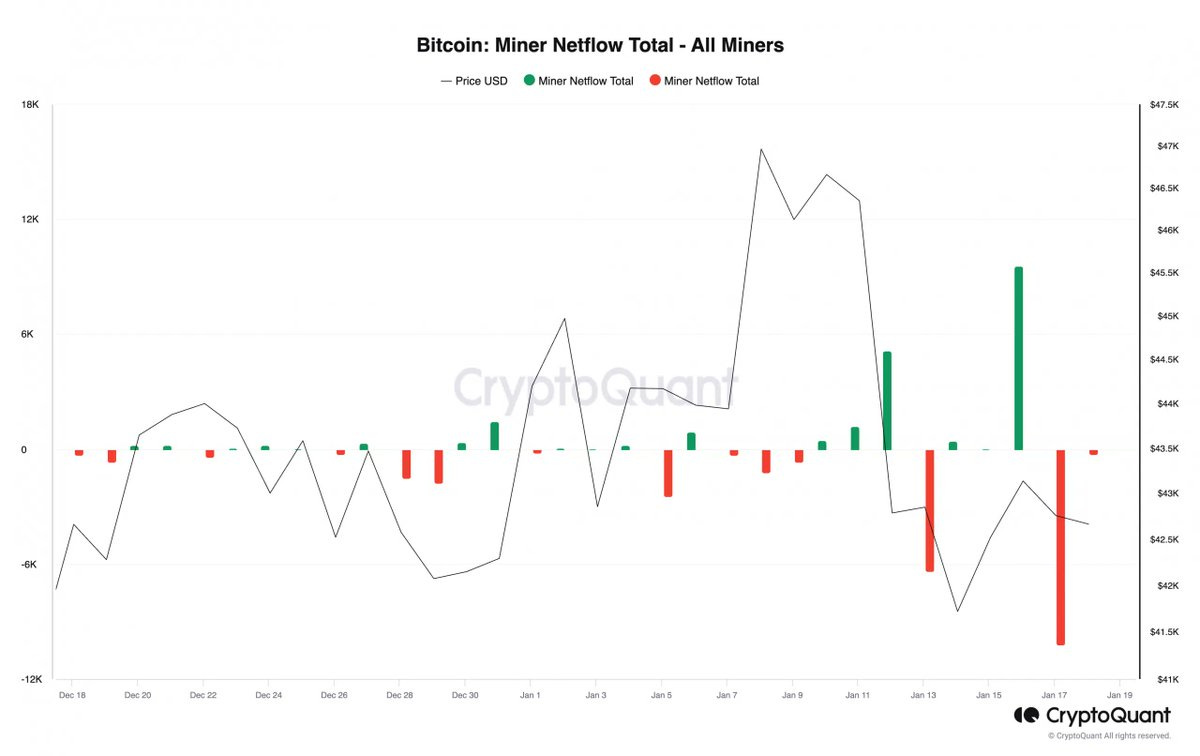

Adding to the selling pressure, there has been a significant sell-off of bitcoin by public Bitcoin miners, who might have anticipated this to be a "sell the news" event, as discussed last week.

Who can blame them? After enduring a prolonged bear market, taking loans against their mining equipment, and accumulating bitcoin at lower prices, it's only reasonable to assume that they aim to pay off debts and have capital available for deployment, especially considering the rapid surge in price since October.

In any case, the quantity of bitcoin held by miners and the daily production of bitcoin is not as significant when compared to Grayscale's GBTC numbers (552,078 bitcoin). The next few weeks will be intriguing as we discover whether the flows continue merely shifting from Grayscale to other spot ETFs or if we witness individual and institutional GBTC investors rushing to exit the bitcoin game for good. After two years of being trapped by GBTC's steep discount to NAV, these investors may be pleased to exit with their cash now that the discount has nearly closed to zero.

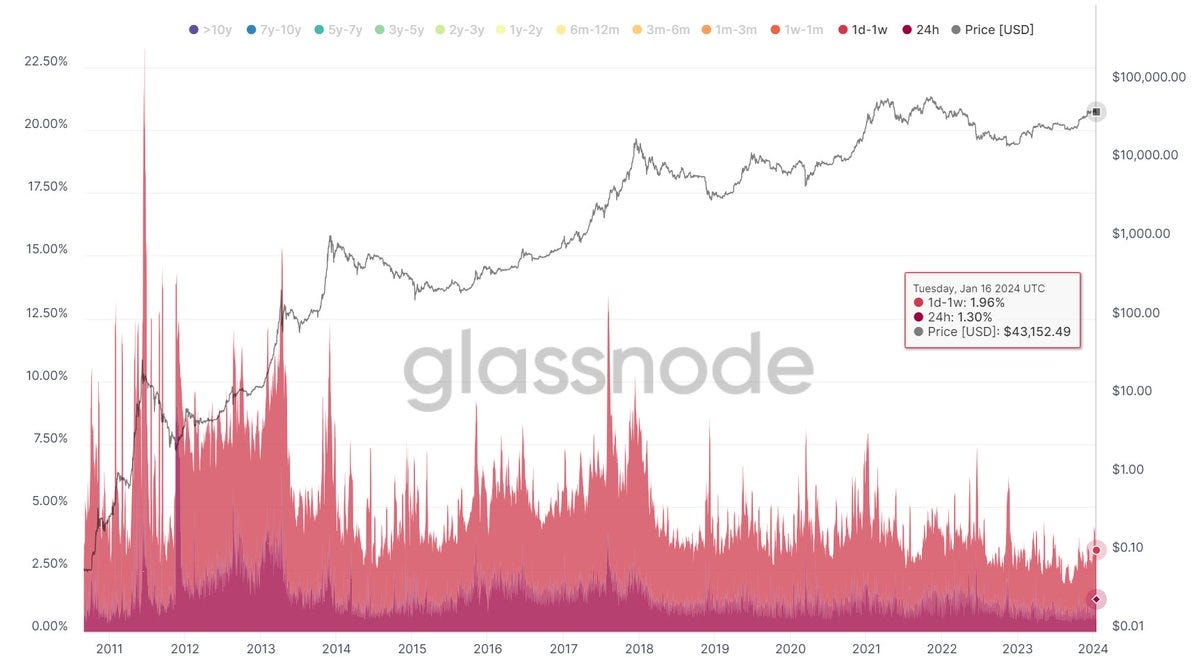

For now, we take comfort in the fact that despite the outflow of bitcoin from miners and GBTC, only 3.26% of the bitcoin changed hands last week. This underscores the 'hodling' conviction of the silent majority, who are likely saving in bitcoin for the very long term.

Stay Humble & Stack Sats,

Bam

Are you a Bitcoiner or a Bitcoin company focused on promoting hyperbitcoinization? Reach out directly to rob@bitcoinnews.com to discuss how we could work together.

P.S. Join us on a mission to craft the ultimate Bitcoin resource delivered straight to your inbox. If you're enjoying our newsletter, why not share the wealth?

Spread the word and pass it along to a friend! Together, let's build a community passionate about all things Bitcoin 👇

I hold and also trade Bitcoin and other cryptocurrency, for example I made good cash from holding solena and XRP which went up 3days ago till date , and now I will advise everyone to buy and store xrp, I was holding $17,000 XRP last week and now it's almost $50,000 I will just withdraw out the profit and leave the rest there because now that Trump is coming on seat xrp will go higher and Bitcoin wi also go higher, I trade Bitcoin. And hold meme coin, if you want to know more or ask any questions about this , subscribe to my page follow me and message me directly I will respond